2024 Digital Advertising Benchmarks For Agriculture

Whether you’re a novice or a seasoned digital marketer, it can be tricky to determine how your digital advertisements are performing compared to the rest of the industry - especially for ag industry advertisers. For years, simply having a digital presence was all that many ag companies needed, but with more digital adoption throughout the industry came more competition. From there, it became increasingly important to establish a benchmark that allows ag brands to measure the success of their digital marketing initiatives.

This is why we set out to develop benchmark performance metrics for the agriculture industry.

Each year we provide an update on the most recent advertising performance across dozens of advertisers in the agriculture industry. This marks our fourth annual update to the digital advertising benchmarks for agriculture.

We analyzed over 4,000 digital campaigns that ran over the last six years and took a deep dive into the ad performance data to understand how our clients (and others in ag) stack up. These campaigns all targeted farmers in North America for a variety of brands and products, including seed, crop protection, fertilizer, machinery and finance.

We gathered data from the Google Ads platform (which includes Google Search, Google Video and Google Display), the Meta Ads platform (which includes Facebook and Instagram), the X (formerly Twitter) Ads platform, as well as direct-to-publisher placements (advertising directly on popular ag publications).

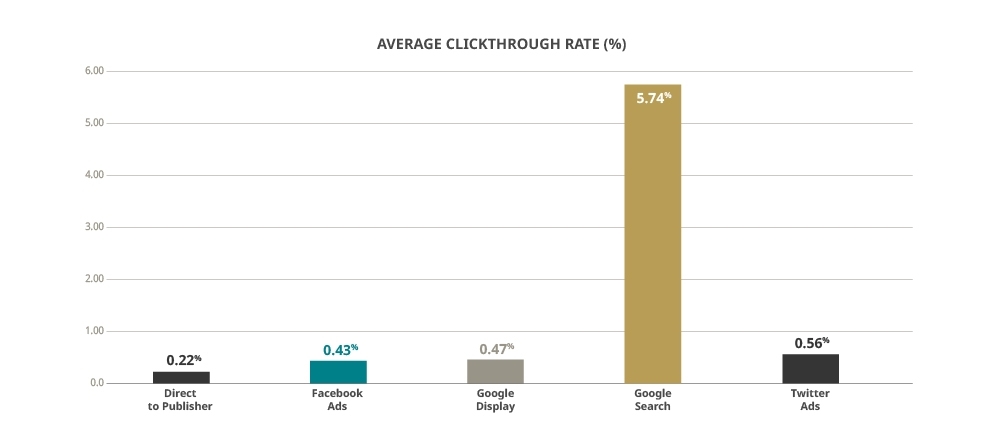

AVERAGE CLICKTHROUGH RATES FOR THE AGRICULTURE INDUSTRY

The average clickthrough rate for digital ads in the ag industry is 5.74% for search, 0.47% for display, and 0.48% for social advertising.

These search rates are much higher than those reported from other industries, while the display rates are on par. Other industries see a CTR of 3.17% for search and 0.46% for display, as per benchmark rates reported by WordStream. Social advertising was not included in their report.

Search advertising tends to have a much higher clickthrough rate because search users exhibit high intent. With search advertising, we can target individuals who are actively researching a particular brand, product, problem or opportunity. These users are looking for solutions, which means they’re more likely to click on ads delivered in this context.

Direct-to-publisher ads saw much lower performance in our analysis, partially due to the nature of the platform. In this format, we don’t benefit from the sophisticated algorithms and machine-learning that allows other popular advertising platforms like Meta and X to find and target an audience that is more likely to click on an ad.

With programmatic advertising, you set campaign objectives and the network delivers your ads to users that are more likely to take the desired action. Direct-to-publisher advertising will almost always be awareness-based, because an advertiser is simply purchasing a block of impressions and not able to optimize based on a desired action.

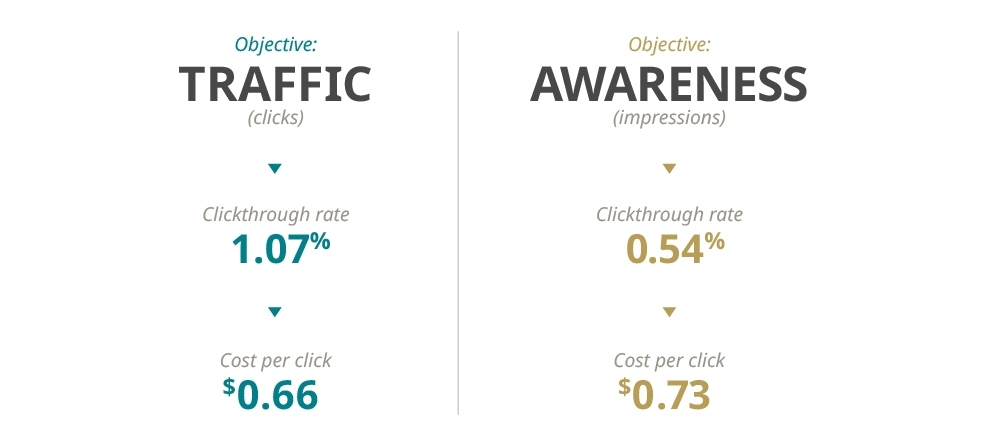

Traffic-based objectives deliver a higher-than-average clickthrough rate, since we rely on algorithms provided by objective-based programmatic advertising. This data shows that these algorithms deliver the desired outcomes.

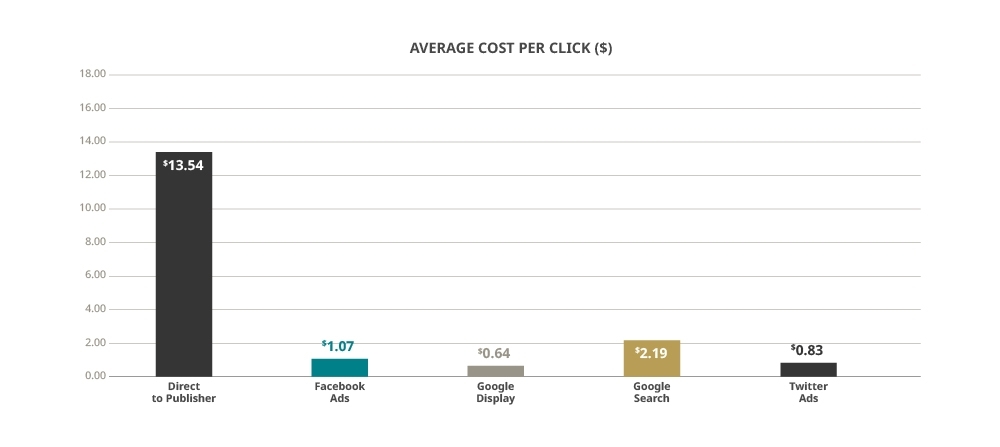

AVERAGE COST PER CLICK FOR THE AGRICULTURE INDUSTRY

Cost per click (CPC) is the average price that an advertiser pays to drive a single click on a digital advertisement. This measures how efficiently an ad or campaign can deliver clicks.

The average CPC for digital ads in the agriculture industry is $2.19 for search, $0.64 for display and $0.96 for social advertising.

Once again, the agriculture industry outperforms all other industries in CPC on search ads and is near the average for display ads. The benchmark rates reported by WordStream are $2.69 for search and $0.63 for display.

The agriculture industry can drive traffic more efficiently because there is less competition for clicks and impressions, so it costs less to deliver ads in North America. In the last two years we have seen a significant adoption of digital advertising practices in the agriculture industry, which is leading to cost increases.

In the chart above, the average CPC for direct-to-publisher campaigns is over three times higher than for other platforms. With direct-to-publisher advertising, an advertiser purchases a block of potentially qualified impressions, but there is no way of focusing on users who are more likely to meet the desired outcome. This format offers a less efficient use of marketing dollars when compared to programmatic advertising options, which optimize performance based on desired outcomes. This is especially true when the goal is to drive traffic to a website.

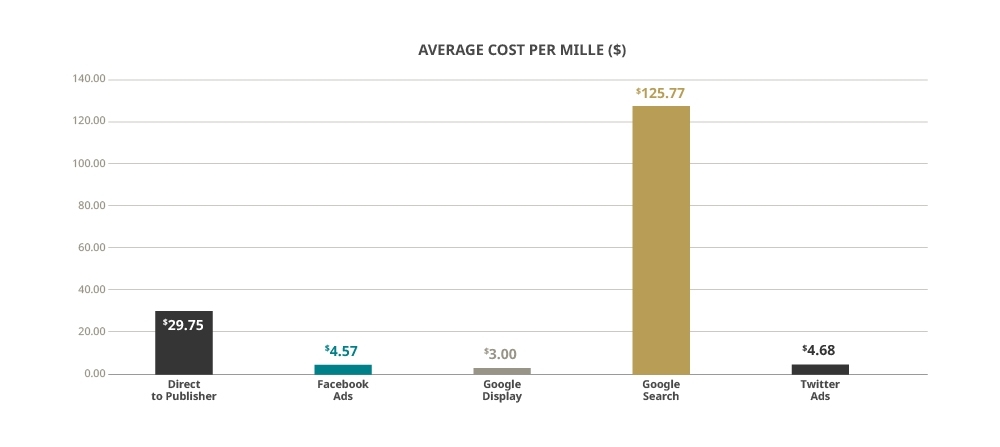

AVERAGE COST PER MILLE FOR THE AGRICULTURE INDUSTRY

Cost per mille (CPM) is the average cost to deliver 1,000 impressions, and measures how efficiently an ad or campaign delivers impressions. Most direct-to-publisher advertising is charged on a CPM basis, so advertisers purchase impressions in blocks of 1,000.

CPM allows us to measure the efficiency of awareness-based campaigns.

The average CPM for the agriculture industry is $3.00 for display, $4.62 for social and $24.45 for direct-to-publisher (we don’t typically report on CPM for search campaigns, as they are always focused on clicks or conversions).

Direct-to-publisher has a higher CPM because these are considered a “premium” service. The placement and inventory are being purchased directly, so it’s more controlled. When it comes to programmatic advertising and social advertising, businesses have less control over where their ads are shown.

NEXT STEPS: MEASURING CAMPAIGN PERFORMANCE

This analysis provides a surface-level overview of digital ad performance metrics for the North American agriculture industry. Feel free to use these benchmarks to measure the performance of your digital marketing campaigns but remember there are many nuances in this data. It’s important to consider your specific goals and objectives when planning, optimizing and reporting on your digital marketing campaigns.

Data Sources

This report is based on a sample of advertising accounts and over 4,000 campaigns that targeted farmers in North America (representing more than $12 million in aggregate spend) between July 2017 and November 2023.

Up Next